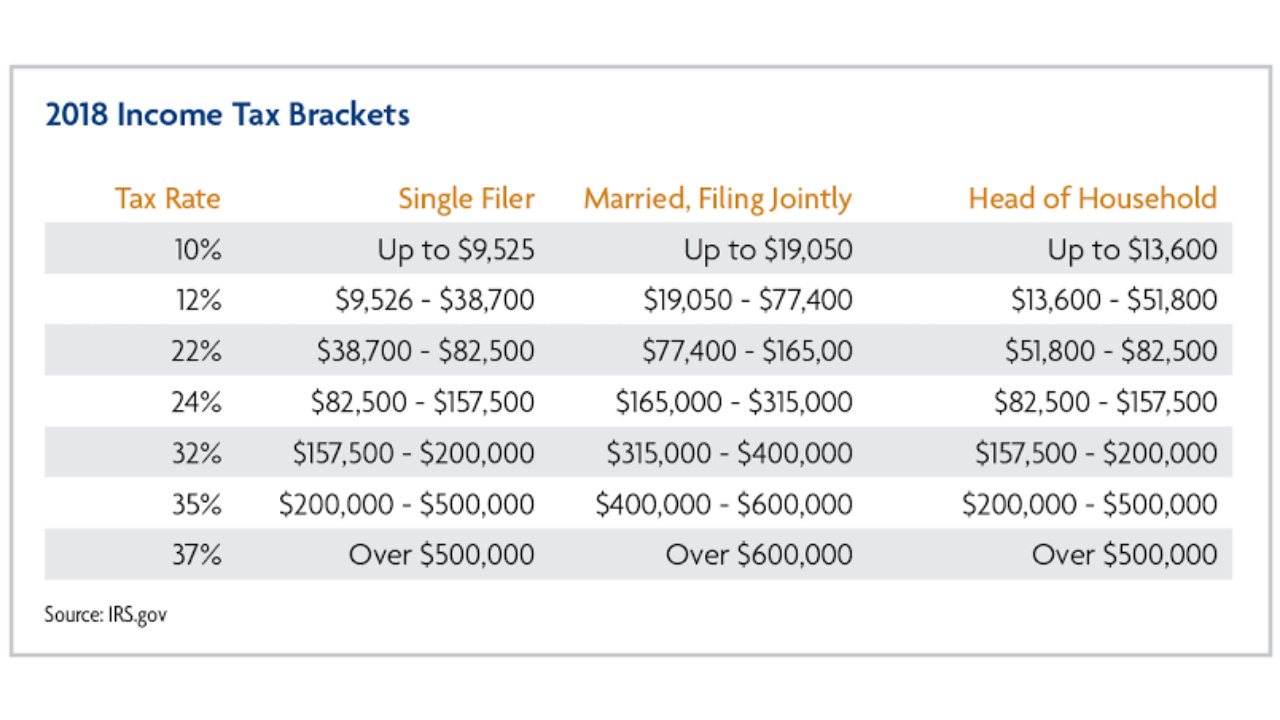

When calculating your Federal income tax, keep in mind that the Federal state income tax brackets are only applied to your adjusted gross income (AGI) after you have made any qualifying deductions. Keep in mind that this estimator assumes all income is from wages, assumes the standard deduction, and does not account for tax credits.įor a more detailed estimate that takes these factors into account, click "View Detailed Estimate" (this will will redirect to an external website). You can use the income tax estimator to the left to calculate your approximate Federal and Federal income tax based on the most recent tax brackets. The new tax bracket was introduced by the American Taxpayer Relief Act of 2012, which among other things also prevented the expiration of the lowest 10% tax bracket, as well as the 25% - 33% brackets, which were set to expire that year. For tax years 2012 and earlier, the highest tax bracket was 35%. In tax year 2013, a new 39.6% tax bracket was added, currently applicable to income over $578,125.00 for single taxpayers. New tax breaks for business owners, such as the Qualified Business Income Deduction were also introduced. While this overhaul lowered rates, it also eliminated many popular tax breaks such as the Personal Exemption. In December 2017, congress passed a sweeping federal income tax overhaul that affects personal income tax rates from tax year 2018 onward. If you qualify for any tax credits, such as the Earned Income Tax Credit or a Homebuyer's Tax Credit, you will deduct these credits from your total tax owed after calculating your marginal tax rates. When calculating your income tax, it's important to remember that the federal tax brackets apply to your gross adjusted income, after accounting for any tax deductions such as dependant exemptions, business expenses, and any other before-tax deductions.

Some individuals may have to follow a special tax structure not listed here, such as the Alternative Minimum Tax (AMT) for certain high-income taxpayers. Only used in rare situations, as you will usually wind up paying more income tax than if you filed jointly.

With typical inflation adjustments a mere 1-2%, the 2023 Federal income tax brackets have been adjusted for inflation by as much as 10.5%. With inflation at historical highs, the IRS has adjusted Federal tax brackets significantly to account for inflation. This page explains how these tax brackets work, and includes a Federal income tax calculator for estimating your tax liability.įederal Income Tax Brackets Indexed for Inflation The Federal Income Tax consists of seven marginal tax brackets, ranging from a low of 10% to a high of 39.6%. Federal income tax brackets were last changed one year ago for tax year 2022, and the tax rates were previously changed in 2017.įederal tax brackets are indexed for inflation, and are updated yearly to reflect changes in cost of living.

0 kommentar(er)

0 kommentar(er)